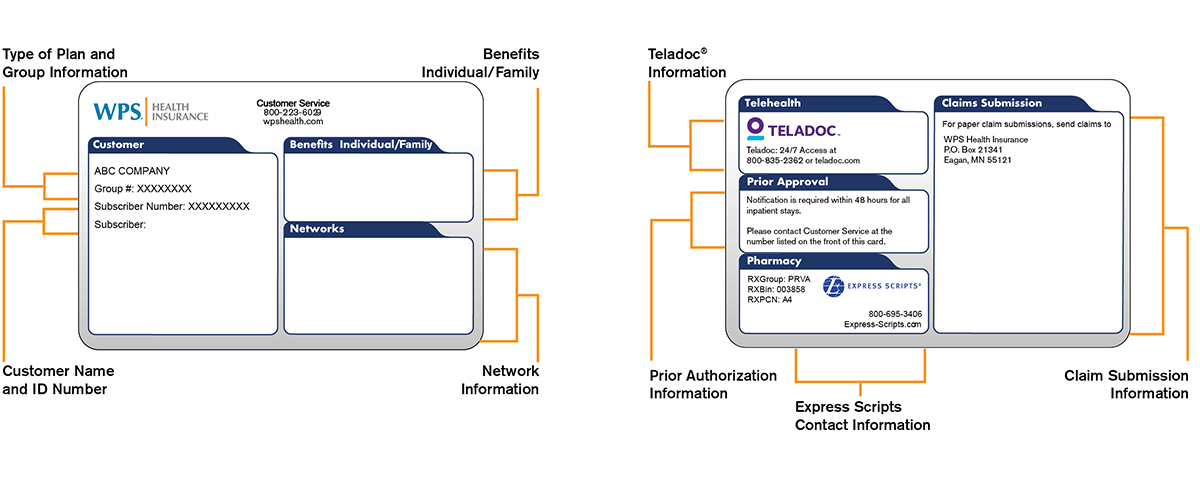

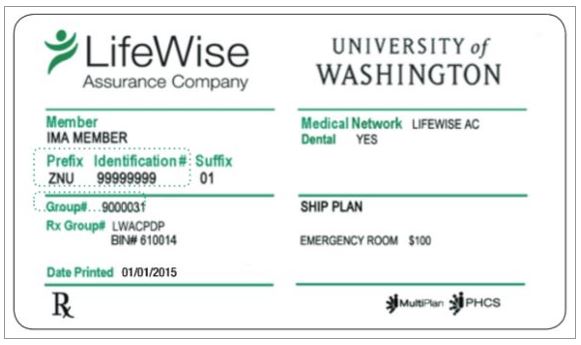

Please present your UHCSR student health insurance ID card each time you receive medical services to ensure proper eligibility verification and claims processing. Please be sure that the provider includes your unique 7-digit StudentResources ID number printed on the front of your card when submitting claims or making inquiries regarding your eligibility. You should point out to providers that ALL inquiries regarding coverage, copays and claims MUST be directed to UnitedHealthcare StudentResources , which is a stand-alone division of UHC. The UHCSR Customer Service toll-free number is listed on the front of your ID card and the claims mailing address is listed on the back of your ID card.

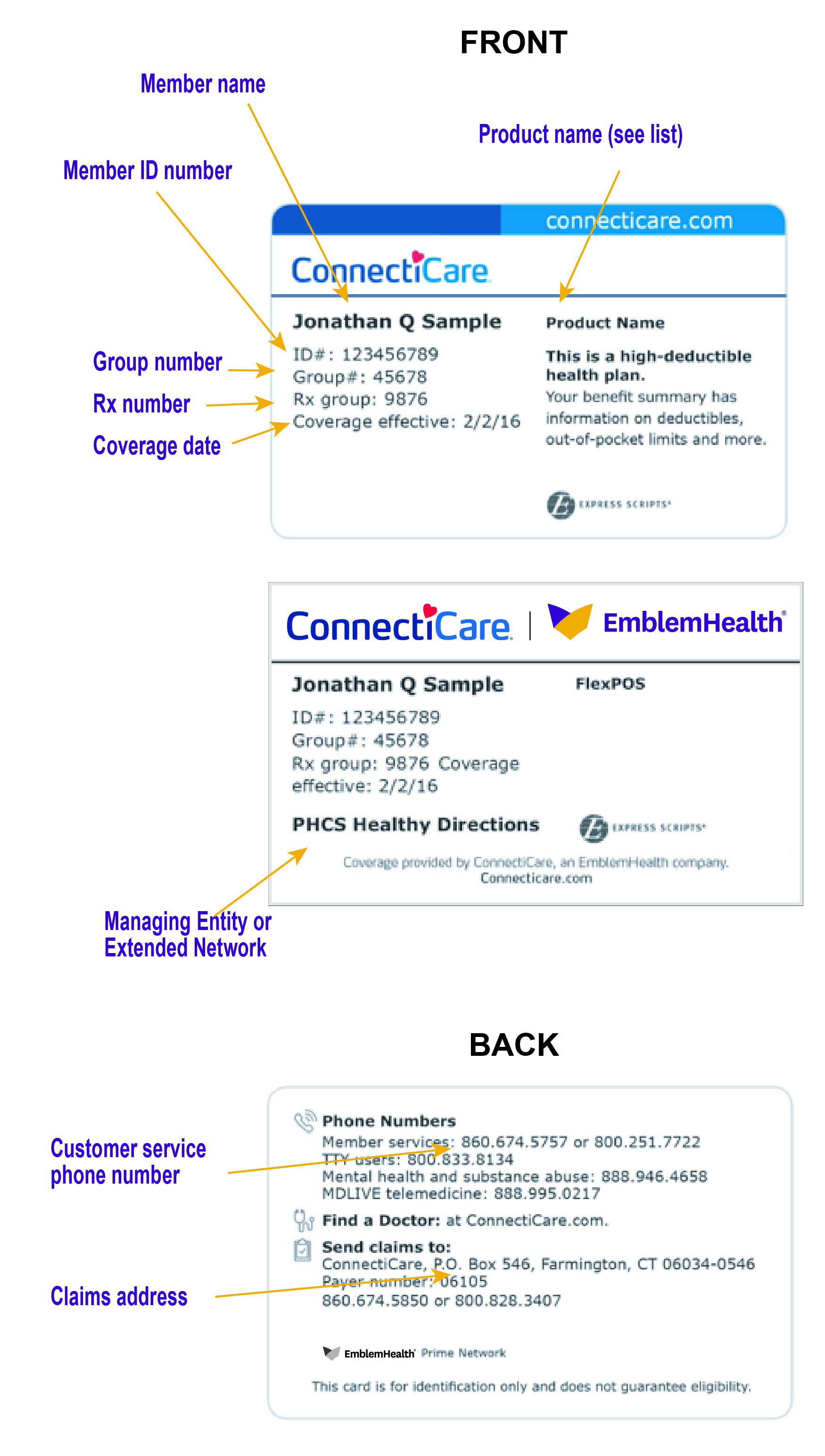

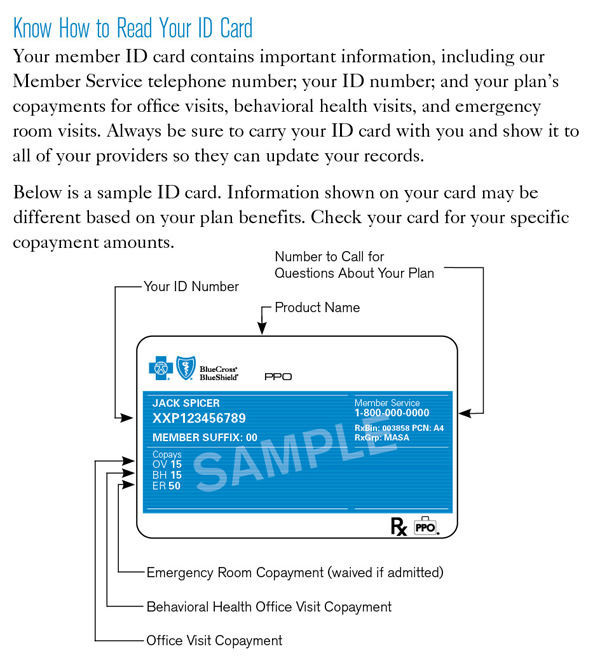

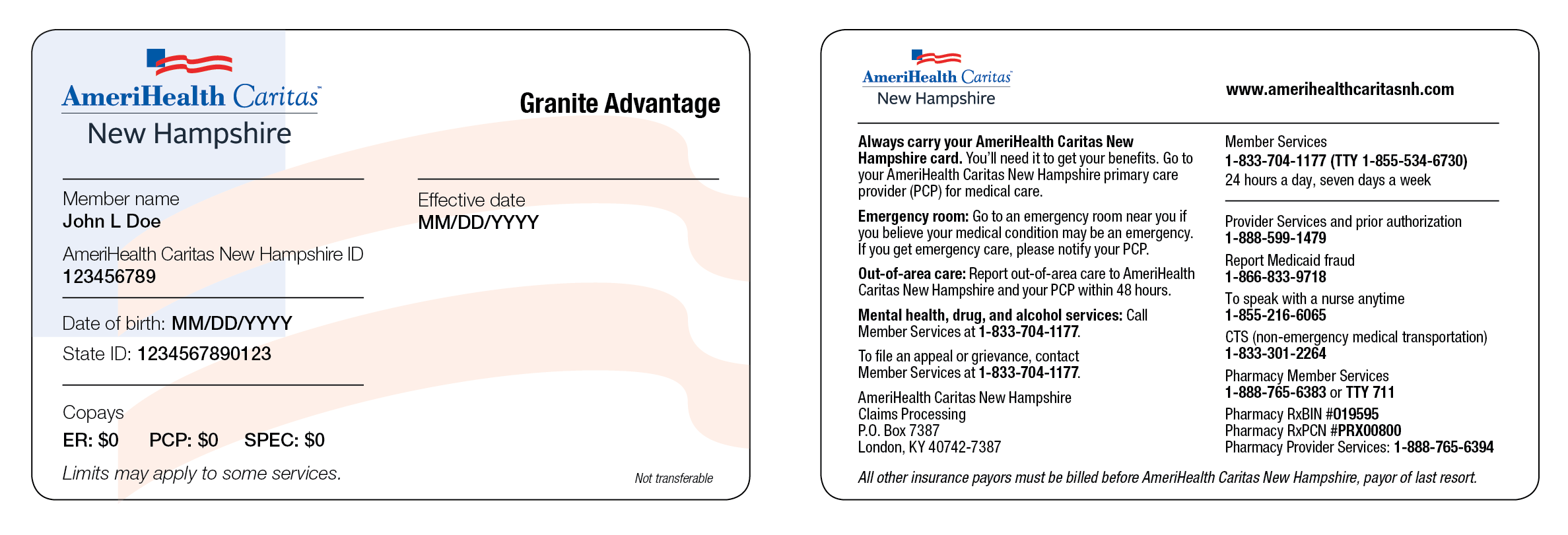

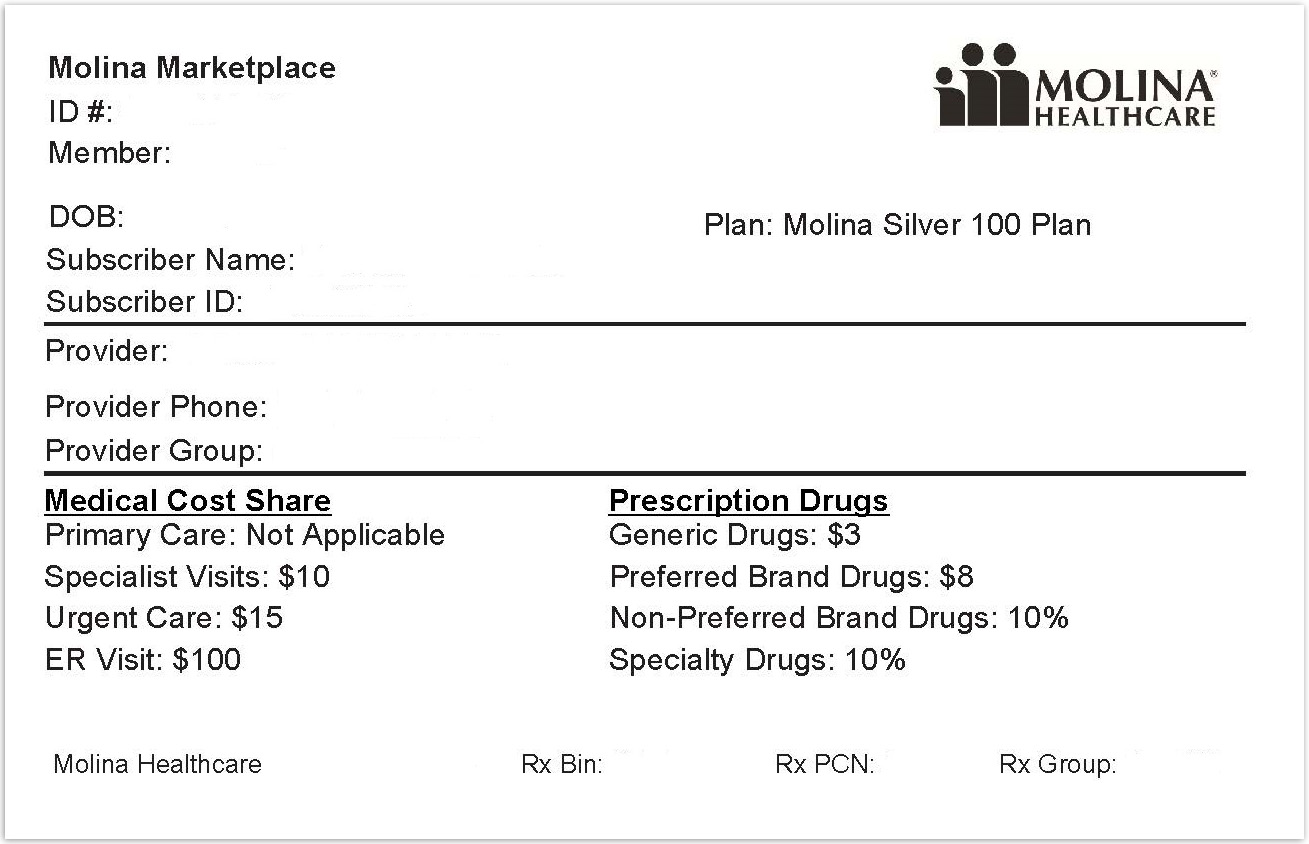

Each person covered by a health insurance plan has a unique ID number that allows healthcare providers and their staff to verify coverage and arrange payment for services. It's also the number health insurers use to look up specific members and answer questions about claims and benefits. If you're the policyholder, the last two digits in your number might be 00, while others on the policy might have numbers ending in 01, 02, etc. Many health insurance cards show the amount you will pay (your out-of-pocket costs) for common visits to your primary care physician , specialists, urgent care, and the emergency department. If you see two numbers, the first is your cost when you see an in-network provider, and the second—usually higher—is your cost when you see an out-of-network provider. For example, when you're referred to a specific specialist or sent to a specific hospital, they may not be in your insurer's network.

A member ID number and group number allow healthcare providers to verify your coverage and file insurance claims for health care services. It also helps UnitedHealthcare advocates answer questions about benefits and claims. If you have family members listed as dependents on your health insurance plan, they may each have their own unique policy number as it is used for identification purposes and billing procedures. Your health insurance policy number is what identifies you as a covered individual under your current or previous plans. It's important because if you change jobs or get married, divorced, etc., then your HIPN will need to match the new situation.

If you move out of state, your HIPN needs to reflect where you live now. Your health insurance policy number is typically your member ID number. This number is usually located on your health insurance card so it is easily accessible and your health care provider can use it to verify your coverage and eligibility.

If you do not see your coverage amounts and co-pays on your health insurance card, call your insurance company . Ask what your coverage amounts and co-pays are, and find out if you have different amounts and co-pays for different doctors and other health care providers. This is usually the amount of your co-payment, or "co-pay." A co-pay is a set amount you pay for a certain type of care or medicine.

Some health insurance plans do not have co-pays, but many do. If you see several dollar amounts, they might be for different types of care, such as office visits, specialty care, urgent care, and emergency room care. If you see 2 different amounts, you might have different co-pays for doctors in your insurance company's network and outside the network. The CHG card helps to identify you as a Community Health Group member. It is important to have all health insurance cards with you and present them to your provider when you access health care services. Your member ID number and group number allow healthcare providers to verify your coverage and file claims for health care services.

These numbers also help UnitedHealthcare advocates answer questions about your benefits and claims. If you have health insurance through work, your insurance card probably has a group plan number. The insurance company uses this number to identify your employer's health insurance policy. The Canadian model for health care is a mixed public/private system; approximately 30 to 40 per cent of normal annual health care expenses are covered through our public healthcare system. The balance is paid directly by individuals (out-of-pocket expenses) or through private health insurance plans, usually through an employer. If you lose your health insurance card with your policy and group number on it, it is important to contact your health insurance company right away and let them know.

Call your insurance provider's customer service number and a representative should be able to help you. When you get a health insurance policy, that policy has a number. On your card, it is often marked "Policy ID" or "Policy #." The insurance company uses this number to keep track of your medical bills.

Your insurance company may provide out-of-area coverage through a different health care provider network. If so, the name of that network will likely be on your insurance card. This is the network you'll want to seek out if you need access to healthcare while you're away on vacation, or out of town on a business trip. You can also provide this number to your health insurance company so they can look up your information when you have questions about your benefits and any recent claims. If you forget or aren't sure what type of health insurance plan you have , you can find out on your BCBS ID card.

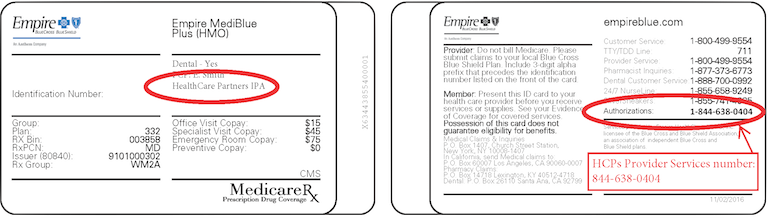

If you have an HMO, your card may also list the physician or group you've selected for primary care. Determining whether a provider is in-network is an important part of choosing a primary care physician. Because events leading to ineligibility can occur at any time, providers are encouraged to verify eligibility at the time services are to be rendered. QualChoice verifies eligibility based on the information we have been provided. Should a member receive benefits outside of the eligibility period, no payment will be made by the health plan, regardless of whether or not eligibility was verified at the time. The Health and Dental Plan provides many benefits not covered by provincial health insurance, such as vision and dental care, as well as coverage when traveling abroad.

Furthermore, it can be combined with other insurance plans to maximize your coverage and benefits. The back of your member ID card includes contact information for providers and pharmacists to submit claims. It also includes the member website and health plan phone number, where you can check benefits, view claims, find a doctor, ask questions and more. Your health insurance company might pay for some or all the cost of prescription medicines. If so, you might see an Rx symbol on your health insurance card.

But not all cards have this symbol, even if your health insurance pays for prescriptions. Sometimes, the Rx symbol has dollar or percent amounts next to it, showing what you or your insurance company will pay for prescriptions. You might see another list with 2 different percent amounts. The descriptions below apply to most private health insurance ID cards in the United States. If you live outside the U.S. or have government-provided insurance, you may see some different fields on your card. The back or bottom of your health insurance card usually has contact information for the insurance company, such as a phone number, address, and website.

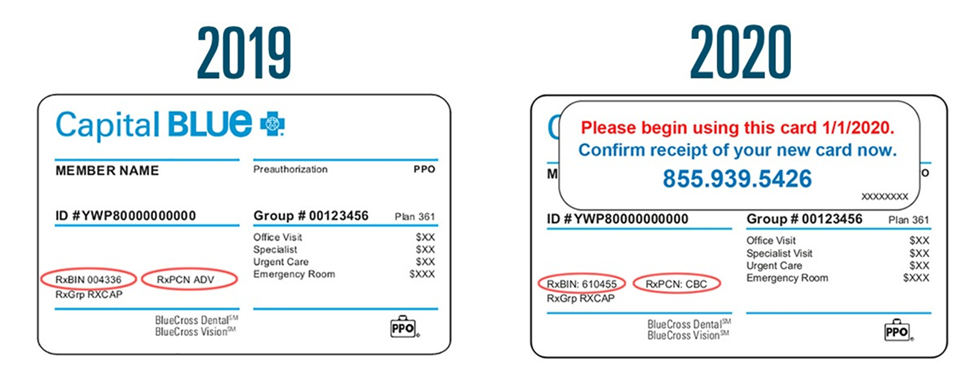

This information is important when you need to check your benefits or get other information. For example, you might need to call to check your benefits for a certain treatment, send a letter to your insurance company, or find information on the website. Different insurance plans sometimes cover different pharmacy networks. For example, CDPHP employer plans use a Premier network; CDPHP individual plans use a Value network; and CDPHP plans for seniors use the Medicare network.

If you enroll in the Standard Plan, Savings Plan, MUSC Plan or Medicare Supplemental Plan, BlueCross provides health insurance cards for you and your covered family members. An insurance policy number is a unique identifier that attaches a car insurance policy to a specific individual. A policy number is assigned to a policy by an insurance company once you have purchased insurance from them. With this number, the other person can call your insurance provider and place a claim. It is assigned to your employer by the insurance company and can also be beneficial for both you and your health care provider in finding out what your coverage entails and submitting claims. The "coverage amount" tells you how much of your treatment costs the insurance company will pay.

This information might be on the front of your insurance card. It is usually listed by percent, such as 10 percent, 25 percent, or 50 percent. For example, if you see 4 different percent amounts, they could be for office visits, specialty care, urgent care, and emergency room care. You use it when you visit the doctor, hospital or other provider.

But, it is also a quick reference that tells you how much you may have to pay. Understanding your card can help you plan your healthcare expenses and get the care you need. The Payer ID or EDI is a unique ID assigned to each insurance company. It allows provider and payer systems to talk to one another to verify eligibility, benefits and submit claims. The payer ID is generally five characters but it may be longer. Your pay direct card allows your service provider to electronically bill Desjardins Insurance on your behalf.

By presenting the card, your pharmacist and dentist will be able to process the claim immediately, so you won't have to pay the full amount up front and wait to be reimbursed. Please note that this service is not universally offered by all health care practitioners. It only applies to providers who are set up to offer the pay direct option to students. Your BCBS ID card has your member number, and in some cases, your employer group number. Your member number, also known as your identification number, is listed directly below your name. You'll need this information when receiving medical services at the doctor or pharmacy, or when calling customer service for assistance.

If your group number is available, you'll find it directly below your member number. The back of the member ID card includes the member website and phone numbers to connect with customer service, speak with a nurse and discuss behavioral health. It also includes contact information for providers and pharmacists to submit insurance claims. To find out if a provider is "in network" contact your insurance company.

After going through, one can get a pretty straightforward idea about the health insurance cards. I think that it is a good idea to maintain an effective health insurance coverage. I think that the cards should also link the patient's previous medical history.

Most health insurance cards contain straightforward identification information about the people covered and the policy you have. Member eligibility is contingent on the member meeting the enrollment qualifications of his/her benefit certificate. You do not need to show an in-network provider your ID card to receive services. However, your ID card includes helpful information and phone numbers for the provider to reference regarding your benefits or discount plan. While you don't need your card, it is important that you always identify yourself as a Superior Vision member.

The back of the member ID card may include phone numbers to connect with customer service, speak with a nurse and find behavioral health support. It also includes contact information for providers and pharmacists to submit claims. If you have coverage from an employer-based health insurance plan, there will most likely be a group number on your insurance card, as well. Verify member eligibility and benefits before rendering, including information on copayments, coinsurance, deductibles and plan limits which may apply to the specific service. Ask member to present a QualChoice ID card at the time of service and include a copy in the patient's file. You must use the BlueCross BlueShield of South Carolina card to receive medical or dental services, the Express Scripts card to fill prescriptions and the EyeMed card to receive vision care.

Express Scripts is an independent company that contracts directly with the State Health Plan. EyeMed is an independent company that contracts directly with the State Health Plan. If your group number is available, you'll find it directly below your member number.

Keep it in a safe, easily accessible place like your wallet. Your card contains key information about your health insurance coverage that is required when you need care or pick up a prescription at the pharmacy. Keeping your card in a secure location will also help protect you from medical identity theft. Our phones, keys, driver's licenses and credit cards are kept at our fingertips at all times.

Those items are unique to each of us, and provide access to the things we need. When it comes to healthcare services, that item is your Blue Cross Blue Shield ID card. Every health insurance card should have the patient's name on it. If you have insurance through someone else, such as a parent, you might see that person's name on the card instead. The card might also include other information, such as your home address, but this depends on the insurance company.

If you have dependents—like a spouse or children—on your health insurance policy, their names might be listed on your card, too. If you are not the policyholder, then your card may show your name and the policyholder's name in separate fields. Your State Health Plan ID card has been redesigned for all members on the 70/30 and 80/20 Plans.

New members or members requesting new cards this month, may notice the new cards. All members will receive them in December, which will reflect the action you took during Open Enrollment. The new cards have a new look to provide greater transparency about your benefits as well as better descriptions of services and required copay amounts.

Show your Medicare card to your doctor, hospital, or other health care provider when you get services. Information on Your Health Insurance Card Insurance company name. The insurance company name and plan type are in the top header of the card.

What Is A Group Id Number On Insurance Card The member name is the name of the person who is covered under the insurance plan. In most cases, your ID card will be required for identification by health care providers. Your BCBS ID card has important contact information to help you reach your BCBS company. Look on the back of your card to find the phone numbers for customer service and eligibility questions.

You can also use our directory to find your BCBS company's website.There you can log into your account and find out more about how to contact the company that provides you service. We encourage you to reach out to your health plan's member services department so that they may assist you with specific questions about your ID card and benefits. If the member fails to provide that cooperation, QualChoice may not be able to determine benefits, or may decide to deny benefits for lack of cooperation. The charges for services would then become the member's responsibility.

ERIE customers may print temporary auto insurance ID cards by registering for an account and logging in. To get started, you'll need to share personal information with us, including your name, address, date of birth and the last four digits of your Social Security number. The new ID card also highlights the fact that the Plan and taxpayers like you ultimately pay your medical bills – NOT Blue Cross and Blue Shield of North Carolina . They process your claims and provide a network of medical providers, but the money to pay your medical bills comes from you and taxpayers like you. In short, the new design helps underscore the value of your Plan benefit. Those who are covered by Quebec provincial health care or receive private insurance can have up to 100% of the remaining costs covered.